The post What is Strategic Thinking? appeared first on Decision Processes International.

]]>Strategic Thinking is easy to say but much harder to achieve in reality. Understanding what strategic thinking is, and how it differs from operational thinking, is the first step in becoming an accomplished strategic thinker.

Strategy versus Operations?

Strategic Thinking is different from both strategic planning and operational planning. In fact, strategic thinking is the framework for strategic and operational plans.

Strategic thinking is the process of thought that goes on inside the head of the CEO and the key people around him or her that helps them determine the “look” of the organisation at some point in the future. And that look, or composition, of the business in the future may be different than it is today.

Strategic thinking can be compared to picture painting. It is the process that helps the CEO and the management team “draw a picture” or “profile” of what they want the organisation to look like at some point in time. It is this “picture” or “profile” that will determine the direction, nature, and composition of the business.

Strategic thinking, then, is the type of thinking that goes on within the mind of the CEO, and indeed the management, to shape and clarify the organisation’s future strategic profile. Decisions that “fit” within the parameters of this profile are taken and implemented, and decisions that do not “fit” rejected.

Operational planning, and even what has become known as strategic planning, is the type of thinking that helps us choose how to get there.

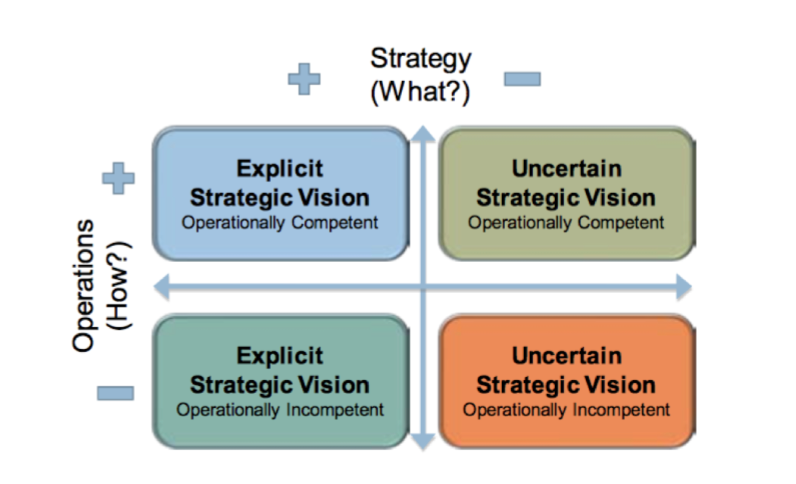

To illustrate the difference between the two types of thinking, we can develop a matrix with the “what” on the horizontal axis and the “how” on the vertical axis.

We can complete the matrix by further dividing each axis into good (+) strategic thinking and poor (-) strategic thinking as well as good (+) operational planning and poor (-) operational planning. Although both of these activities go on in all organisations, what we have noticed is that they go on with varying degrees of proficiency.

In quadrant A, we find companies that do both very well. They have developed a clear profile and explicit strategy, and they manage their business successfully on an ongoing basis. Companies that fall into Quadrant A include the likes of Apple.

In quadrant B, we find companies that have been successful by managing their ongoing operations effectively, but which cannot articulate where they’re going. In other words, management can keep churning out good operational results quarter after quarter, but they do not have a shared vision of what the company will “look like” as a result of all that churning.

In quadrant C, we find the opposite situation. This is where many “copy cat” firms reside. For example, think back to the years when there were many firms competing in the nascent PC business. Each company probably had a very clear strategy: “Be the best IBM clone we can be.” However, many of these companies had great difficulty making this strategy occur; thus, their fortunes were up and down like yo-yos. Today, most of them are out of business!

The last quadrant is the worst of both worlds. Here we find organisations that do operational and strategic thinking poorly. Companies that fall into quadrant D usually don’t survive very long.

Which quadrant is your organisation in?

Although we would all like to say that we are in the A quadrant, most of our clients readily agree that they fell into B. That is, they are effective operationally but aren’t always sure what direction they are pursuing. As a matter of fact, our experience has shown that almost 70 to 80 percent of companies are in that position.

Surprising? Not really, when we explore some of the reasons for this. Here are two major explanations.

Firstly, most of the people who lead and manage organisations got there from the operational ranks. They were promoted from one level to the next because of their operational skills. They were good managers and made good operational decisions. They were able to “make the numbers”. They did not, however, spend much time thinking about, or charting, the direction of the company. As a result, they have not acquired the skill of setting direction and being the organisation’s strategic thinker. That skill takes time to develop.

Secondly, the need for management to think strategically does not arise all of the time. It tends to surface only at “strategic retreats” or when a new “strategic thrust” is being pursued, for example, when deliberating entry into market(s) that represent unfamiliar terrain. Often, the rules of the game are different requiring management to shake itself out of its operational thinking boots. However, if thinking strategically is not an on- going habit, one can hardly expect management to be proficient.

Christopher Columbus School of Management

Let’s then return our attention to “Quadrant B” where 70% to 80% of organisations reside. These companies can be referred to as being part of the Christopher Columbus School of Management, the explorer who:

- When he left, he didn’t know where he was going

- When he got there, he didn’t know where he was

- When he got back, he couldn’t tell where he had been!

But he got there and back three times in seven years! Columbus was operationally competent but a very poor strategist!

To avoid being like Columbus a robust strategic thinking process is required. The process should guide and promote the type of thinking necessary as management attempts to determine what an organisation should “look” like in the future. Operational planning systems, on the other hand, can be used to later to help determine how to get there.

Strategic thinking is a fresh approach to the subject of strategy. It identifies the key factors that dictate the direction of an organisation, and it is a process that the organisation’s management uses to set direction and articulate their vision. For strategic thinking to be successful, it is necessary to obtain commitment of the organisation’s key executives and the commitment of others who will called upon the implement that vision. Naturally, the vision is greatly shaped by the CEO.

It is a process that extracts from the minds of people who run the business their best thinking about what is happening in the business, what is happening outside in the environment, and what should be the position of the business in view of those highly qualitative variables (opinions, judgments, and even feelings) – not the quantitative ones. Strategic thinking produces a vision, a profile, of what an organisation wants to become, which then helps management make vital choices. It enables management to put the corporation in a position of survival and prosperity within a changing environment.

The post What is Strategic Thinking? appeared first on Decision Processes International.

]]>The post What is Strategy Anyway? appeared first on Decision Processes International.

]]>by Richard W. Oliver

On the face of it, defining “busi- ness strategy” seems like a no-brainer. Yet when I was confronted with the challenge recently in a faculty meeting, I found myself rather less than articulate. “Bad form!” you might say, for a pro- fessor of the subject and more impor- tantly, a columnist on strategy.

Okay, so you got me. But before you get too critical dear reader, how about taking a shot at it yourself?

… I’m waiting …

Ah, see what I mean? It’s not as easy as it might at first appear. The fact is, there are many definitions of strategy, some are highlighted here.

Defining Strategy

Well, I finally got my act together and will share with you now my humble (and brief) contribution to the strategy definition debate:

Strategy is understanding an industry structure and dynamics, determining the organization’s relative position in that industry, and taking action to either change the industry’s structure or the organization’s position to improve organizational results.

This definition encompasses all the major activities undertaken in the strategy process and should focus practitioners and scholars alike on what’s important (i.e., what drives the amount and nature of corporate success). Industry structure and dynamics determine the broad para- meters of growth and earnings poten- tial and delimit what is realistically possible to achieve. The firm’s relative position in a given industry structure sets its specific achievement profile and the scope of its strategic options. Finally, industry or organizational change defines the specific organizational responses to its strategic (structural and positional) circumstance and aspirations.

While no definition is perfect (and granted, this one suffers from lack of detailed specifics when compared to some of those offered in the list that appears later), it does offer the practi- tioner a general place to start in determining an approach that a par- ticular firm might use.

To help broaden your thinking about the definition of strategy, I offer a brief review of the history of strategic thinking.

Download the full article here

The post What is Strategy Anyway? appeared first on Decision Processes International.

]]>The post How to get more from your online marketing. 4 Strategies. appeared first on Decision Processes International.

]]>by Colleen Backstrom

Way back in 2007 Harvard Business School put out a paper entitled “Fixing the Marketing — CEO Disconnect”, which highlighted the gap between the marketing function and the C-suite. It emphasised that too much delegation of responsibility to the marketing department can result in marketing activities, which are not supportive of the company’s greater strategic goals. In 2011 the fundamental nature of marketing has shifted so rapidly that many CEOs, given the pressures of other priorities, have found it hard to keep pace.

Digital has become core to the future of marketing.

The days when digital simply meant a PR website are over. 2011 marketers require online to be more productive. They appreciate the extra reach that the internet offers and are making the deep strategic shift to make online work; digital needs to accelerate revenue growth; and digital needs to find new clients and generate real leads.

This requires a mind shift from the way we’ve done things before. And the CEO is the one that should be driving this mind shift to ensure that online marketing activities are aligned with strategic objectives. Unfortunately,

however, CEOs have often felt out of their depth when it comes to the inter- net and have left online marketing up to the marketing divisions completely. To make matters worse, the online marketing function in some corpo- rates has now been taken over by the IT department, because “they’re the only ones that understand the technol- ogy.” This gives us communications

that work technically, but the strategic marketing objectives have been lost somewhere down the line.

How to fix the rift?

Download the full article here

The post How to get more from your online marketing. 4 Strategies. appeared first on Decision Processes International.

]]>The post Ten Deadly Sins That Lead to Corporate Extinction appeared first on Decision Processes International.

]]>by Michel (Mike) Robert — Founder, Decision Processes International

“It’s easy to develop a strategy, it’s the implementation that’s difficult.” This is a statement we have frequently heard over the years. Our own experience proves that the exact opposite is true. If a CEO thinks that he or she has a solid strategy, and yet it’s not being implemented, only one of two things can be happening:

1) The management team doesn’t know or understand the strategy (it’s very difficult to implement a secret strategy).

2) If the strategy is understood but still not being implemented, it’s because some members of the man- agement team don’t agree with it and may, in fact, be trying to sabotage it.

In our view, there are ten deadly sins that an organization can commit that will inevitably lead to one of these two conditions, and eventually to cor- porate extinction.

Download the full article here

The post Ten Deadly Sins That Lead to Corporate Extinction appeared first on Decision Processes International.

]]>The post What is Critical Thinking? appeared first on Decision Processes International.

]]>What do Michael Phelps and Placido Domingo have in common?

Not so obvious is it? Here’s a hint: they both excel at a skill which many of us take for granted, are not able to “control” and, for the most part, are not consciously aware of. Yet, this is a skill that is essential to life.

If you’ve not got it, the skill we’re referring to is breathing. Luckily for us, “basic breathing” is not something that requires conscious effort. Imagine how tedious life would be otherwise. However, notwithstanding the impact of yoga over the last 20 years, few people really understand how to breathe correctly or have studied the art as a part of a conscious effort to improve their ability. What about you? Can you control your breathing in response to different situations?

Why then do these individuals bother? The answer is that for their chosen profession it is not a ‘nice-to-have’ or something taken for granted. “Professional standard” breathing is an explicit and critical skill essential to their success.

Thinking is the breathing of business

We hope that the parallel between breathing for Phelps and Domingo and thinking for those of us wishing to be winners in business is obvious. Quite simply, thinking is the “breathing” of business. For us to be successful in our corporate lives, or as an entrepreneur, “gut feel” thinking is rarely sufficient in the complex and fast-paced world we live in.

DPI’s raison d’être is to help our clients and their employees at all levels to think critically. This leads to two obvious questions:

What separates critical thinking from “ordinary” thinking?

Can critical thinking be learnt?

What is Critical Thinking?

The success and failure of any organisation rests on the quality of the thousands of decisions made and implemented every day, every week and every month. Like much other business jargon, the term “Critical Thinking” has been around for many years. However, few can describe what it is, and fewer still can explain how to do it. Let us offer a very down to earth definition: Critical Thinking is thinking that is critical to success and, therefore, is too important to be left to chance.

Good Critical Thinkers possess the following attributes:

- Ability to ask specific and incisive questions at the right time

- Awareness of where they and others are in their thought process

- Clear-thinking even when under pressure or working on issues outside of their domain expertise or core experience

Here are some examples of real situations faced by our clients. How would you react if confronted with any of these?

- Two weeks away from a product launch the Strategic Partner pulls out, and the marketing campaign has already been set in motion.

- Developing a recommendation for a new CRM system when you are completely unfamiliar with the topic.

- Facilitation of an impromptu meeting to uncover the reason for a host of customer service issues.

Would you know where to begin? What you would do first? How to proceed? Which questions to ask? Would “ordinary” or sub-conscious or “gut feel” thinking suffice?

It is in these situations that the ability to consciously “activate” critical thinking processes – reusable and expeditious road-maps of how to gain clarity, address problems, make decisions, be innovative – come to the fore.

The winning organisation of the future will be the one that can out- think, not out-pace, the competition. This out-thinking shouldn’t be restricted to the top echelons of management, so the leader must also take steps to be a critical thinking coach. The leaders who figure out how to harness the collective genius of the people in their organisations are going to blow the competition away.

As the famous saying goes, “Give a man a fish and you feed him for a day. Teach him how to fish and you feed him for a lifetime”.

For more information on critical thinking please contact us

The post What is Critical Thinking? appeared first on Decision Processes International.

]]>The post The Four Deadly Sins that Kill Strategic Product Innovation appeared first on Decision Processes International.

]]> Since new-to-the-market products are the essence of strategic supremacy, why are companies spending their time, money and energy on product extensions at the expense of new-to-the-market products?

Since new-to-the-market products are the essence of strategic supremacy, why are companies spending their time, money and energy on product extensions at the expense of new-to-the-market products?

Most companies commit one, or more, of four ‘sins’ that kill new product creation and lead to a company’s loss of supremacy over its competitors. Unfortunately, all 4 sins are self- inflicting wounds:

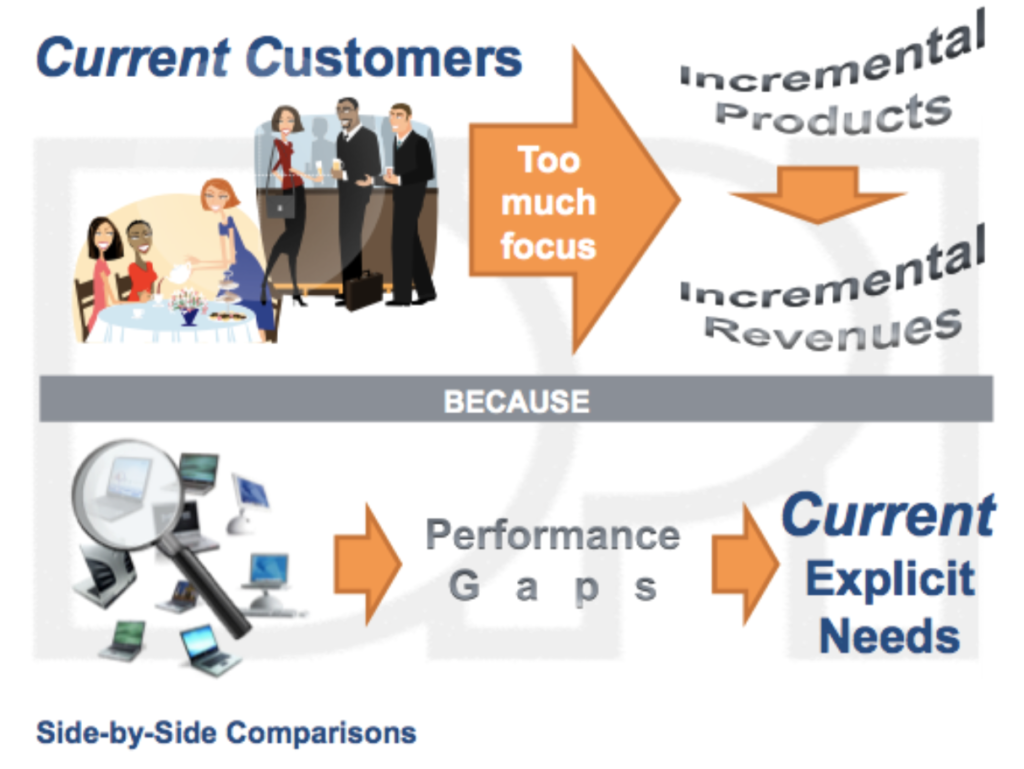

Sin 1: Too Much Focus on Current Customers

Who do most books on product innovation tell you to consult in order to get inspiration for new products? The obvious answer: your customers. WRONG – dead wrong! If a company focuses its entire effort on current customers as a source for new products, it will always end up with incremental products. The reason is very simple. Current customers are very good at telling you what is currently wrong with your current product. They can do this well because they do side-by-side comparisons and they identify performance gaps in your product relative to your competitors. Naturally, you go back to the factory, tweak the product a little and come back with an incremental improvement. And the pattern is set and keeps repeating itself.

Worse than that, your current customers can begin to dominate your product development process. You cannot rely on current customers for your new product ideas because they are not always aware of what they will need in the future. For example:

Q: How many of 3M’s millions of customers asked 3M for Post-it Notes?

A: None.

Q: How many of Sony’s millions of customers ever asked Mr Akio Morita (Sony’s founder) for a Walkman?

A: Not one.

Q: Did anyone on this planet ever ask Steve Jobs and Steve Wozniak for an Apple computer, iPad or iPhone?

A: No. Never.

In order to propagate competitive supremacy and create new revenue streams, it is imperative to concentrate a company’s product innovation resources on new-to-the- market products. Livio De Simone, retired CEO of 3M, once said: “The most interesting products are the ones that people need but can’t articulate that they need”. New-to-the- market products satisfy the future implicit needs that you have identified and that your customers cannot articulate to you today. The upshot will be products that will allow you to change the game.

Sin 2: Protect the “Cash Cow” Mentality

Every company, over time, has products that become cash cows. Never worship at the altar of the cash cow. You will lose your supremacy.

IBM’s cash cow, as we all know, had been its mainframes – once the workhorses of the computing industry. In 1968, in its Swiss laboratories, IBM invented the first microchip – the RISC chip – with more processing capacity than its smaller mainframes. A small computer prototype, powered by this chip, was built and could have been the first PC the world saw. IBM, however, made a deliberate decision not to introduce that chip, because it could foresee the devastation it might have on its mainframe business. In 1994, 26 years later and maybe 26 years too late, IBM finally introduced the RISC chip under the name PowerPC. In the meantime, IBM lost the opportunity to be the powerhouse in the consumer market that it is in the business market.

“There is no such thing as a mature market. What we need are mature executives who can make markets grow”.

Sin 3: The Mature Market Syndrome

“Our industry is mature. There is no more growth in these markets”.

Many people would claim that the reason products become generic, prices come down to the lowest levels, and growth stops is that the ‘market is mature’. Mature markets are something of a myth.

Who would have believed 20 years ago – when everyone owned a £10 pair of trainers – that people would pay £100 for a pair? Some of these trainers are solely worn for fashion purposes and unlikely to ever see a running track! Along came Nike and Reebok and the ‘mature market’ exploded.

A few short years ago Starbucks revolutionised the takeout coffee business by introducing unique products and marketing in a ‘mature’ industry. Now our high streets and public transport systems are jammed with takeaway- coffee-cup-hugging individuals.

Lawrence Bossidy, formerly CEO of Allied Signal couldn’t have summed it up better when he said: “There is no such thing as a mature market. What we need are mature executives who can make markets grow”.

Sin 4: The Commodity Product Fallacy

“We’re in the commodity business” is another mind-set that can bring down a company’s supremacy. This is also a state of mind. Products become commodities when management convinces itself that they are. It’s a self-fulfilling prophecy.

An example is baking soda, a ‘commodity’ product that has been around since the days of the pharaohs. One day someone placed a small quantity in a refrigerator and noticed that it absorbed odours, soon afterwards the launch of deodorant with baking soda. We’ve since had teeth whitening baking soda toothpaste, not to mention dishwasher tablets and sink unblockers with this same ingredient.

Then there is the ‘mother’ of all commodities – water. Look at what the French can do with water. They have mastered the marketing of this mundane commodity by branding it under a variety of names such as Vitel, Evian and Perrier. Knowing that people are becoming more concerned about the quality of the water they drink, they began to market bottled water at exorbitant prices. This concept was immediately successful even in places where tap water is excellent and essentially free. Through brilliant marketing, they made water ‘trendy’.

Drinks manufacturers have taken the concept a big step further by adding nutrients to water to create a new category: sports water. Some of these even incorporate the ‘grandmother’ of all commodities: oxygen.

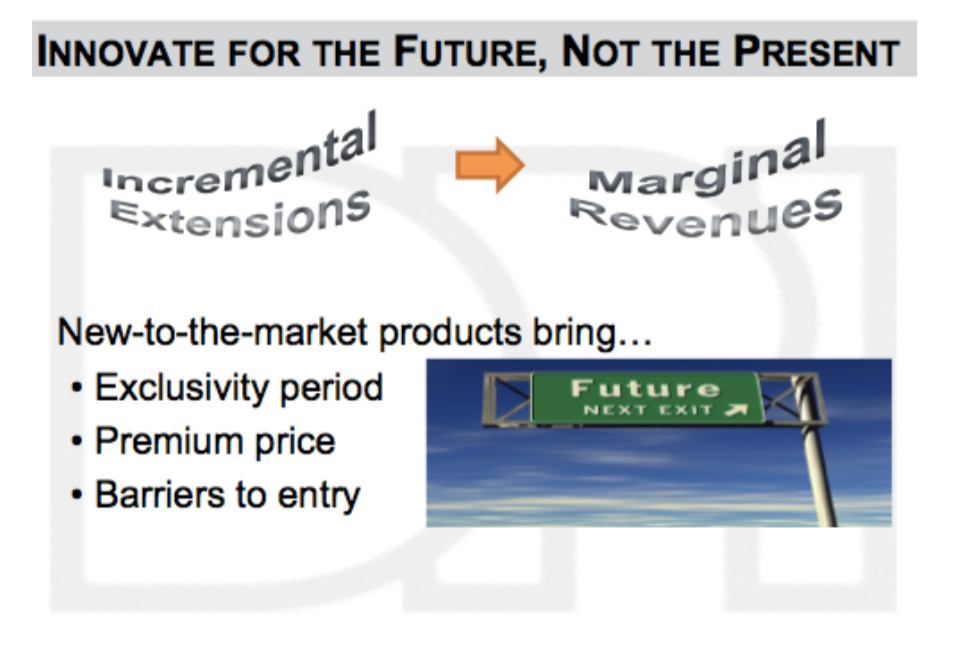

NEW TO THE MARKET PRODUCTS BREED SUPREMACY

Sony, 3M, Canon, Microsoft, Johnson & Johnson, Dyson and many others maintain their control of the ‘sandbox’ not be introducing ‘me-too’ products but rather by focusing their resources on the creation of new-to-the-market products. These have three inherent characteristics that contribute to propagating supremacy over their competitors:

- A period of exclusivity. When you are the only product in the market, you are the only one.

- Capability of charging premium prices. During this period of exclusivity, you can obtain premium prices, as opposed to me-too products, where every transaction comes down to haggling over price.

- Ability to build in barriers. Being first to the market allows you to build in barriers that make it very difficult for competitors to gain entry into your game.

After all, that’s what supremacy is all about: changing the game and creating the rules to which competitors who wish to play your game must submit.

THE NEED FOR PRODUCT INNOVATION

DPI’S Strategic Product Innovation Process is a powerful tool that can help jump-start your organisation’s ability to generate a steady stream of innovative new product and/or service concepts, and to identify opportunities for entirely new markets and customer groups. The future holds vast opportunities for growth, if you know how to use change to your advantage.

Get in touch if you want to learn how to develop a continuous pipeline of new products/services for your organisation.

The post The Four Deadly Sins that Kill Strategic Product Innovation appeared first on Decision Processes International.

]]>The post How Strategic Product Innovation breeds Competitive Supremacy appeared first on Decision Processes International.

]]>Looking at the Forbes 2014 list of the World’s Most Innovative Companies, you see some of the “usual suspects” – Amazon.com, Unilever and Coca Cola. In fact, in these most successful companies, innovation is a paranoiac need. The lifeline of any unregulated organisation is its ability to continuously find opportunities for new products or services and to develop better processes to manufacture and deliver them.

New Products Are Not Always New Products

Any company that wishes to perpetuate its supremacy over a long period of time needs to have in place an on-going, aggressive and successful new product creation program. However, during our research into the subject of product innovation, we noticed that most companies concentrate their entire product innovation effort on incremental or marginal improvements to existing products. In fact, while working with companies considered to be the best at product innovation, we discovered that these companies even had difficulty defining what a new product was.

Over time, we have uncovered five categories of new product opportunities.

- New to the market. These are products that, when introduced, were unique to the market and the world. No similar products existed anywhere. Examples are 3M’s Post-It Notes, Sony’s Walkman VCR, and Apple’s iPad.

- New to us. When Panasonic introduced its own version of the VCR, it was not new to the market since Sony had done it before. But it was new to Panasonic.

- Product extensions. In this category, we find two types: incremental and quantum leap. An example of an incremental extension is 3M’s adaptation of the original Post-It Notes into larger sizes, shapes, with colours and adaptations like flags, tabs and dispensers. Boeing’s announcement of a supersonic passenger jet is a quantum leap extension. The technology required is a significant step beyond making its standard passenger jets.

- New customers. This category applies to the introduction of current products to new customers, such as e-readers tapping into the textbook market.

- New markets. This category applies to the introduction of current products to new market segments or new geographic areas, such as Subway’s steady global expansion.

The next area we investigated was: In which category did they invest most of their resources? Guess what over 200 companies answered? Right: product extensions – of the incremental type. The food and packaged goods industries, for example, have perfected the art of “new and improved” products in different colours and sizes. Unfortunately, incremental extensions only bring incremental revenues. Only new-to-the- market products create new revenue streams.

The 4 deadly sins that kill strategic product innovation

Since new-to-the-market products are the essence of strategic supremacy, we then set out to identify the obstacles that caused companies to spend almost all of their time, money, and energy on product extensions at the expense of new-to-the-market products. Our discovery? Most companies committed one or more of four “sins” that killed new product creation and led to a company’s loss of supremacy over its competitors. Unfortunately, all four were self-inflicted wounds.

Sin 1: Too Much Focus on Current Customers. Who do most books on product innovation tell you to consult in order to get inspiration for new products? The obvious answer: your customers. Wrong, dead wrong! If a company focuses its entire effort on current customers as a source for new products, it will always end up with incremental products. The reason is very simple. Current customers are very good at telling you what is wrong with your current product. Naturally, you go back to the factory, tweak the product a little, and come back with an incremental improvement. And the pattern is set and keeps repeating itself.

You cannot depend on current customers for your new product ideas because they are not very competent at telling you what they will need in the future. Not one of 3M’s millions of customers ever asked 3M for Post-it Notes. Not one of Sony’s millions of customers ever asked for a Diskman or a VCR. No one on this planet ever asked Steve Jobs for an Apple computer or an iPod or an iPad. And the list goes on. These are all products that originated in the minds of the creator, not the recipient. Jobs, perhaps the best and most influential innovator of recent times said, “It’s not the customer’s job to know what they want.”

You cannot depend on current customers for your new product ideas because they are not very competent at telling you what they will need in the future. Not one of 3M’s millions of customers ever asked 3M for Post-it Notes. Not one of Sony’s millions of customers ever asked for a Diskman or a VCR. No one on this planet ever asked Steve Jobs for an Apple computer or an iPod or an iPad. And the list goes on. These are all products that originated in the minds of the creator, not the recipient. Jobs, perhaps the best and most influential innovator of recent times said, “It’s not the customer’s job to know what they want.”

In order to breed competitive supremacy and create new revenue streams, it is imperative to concentrate a company’s product innovation resources on new-to-the-market products.

These are products that satisfy future implicit needs that you have identified and that your customers cannot articulate to you today. In this manner, the result will be products that will allow you to change the game and perpetuate your supremacy. If you know where to look, identifying changing needs is not as hard or miraculous as it may seem.

Sin 2: Protect the “Cash Cow” Mentality. Every company, over time, has products that become cash cows. Never worship at the altar of the cash cow. You will lose your supremacy. Here are some classic examples.

IBM’s cash cow, as we all know, had been its mainframes, once the workhorses of the computing industry. In 1968, IBM invented the first microchip, with more processing capacity than its smaller mainframes. A small computer prototype, powered by this chip, was built and could have been the first PC the world saw. IBM, however, made a deliberate decision not to introduce that chip, because it could foresee the devastation it might have on its mainframe business. In 1994, 26 years later and maybe 26 years too late, IBM finally introduced the chip under the name PowerPC. Meanwhile, IBM lost the opportunity to be the powerhouse in the consumer market that it was in the business market. In 2005, IBM eventually admitted defeat in the PC space and sold out this arm to Lenovo.

The same happened at Xerox. The company worshipped so diligently at the altar of large copiers that it did not see the advent of a stealth competitor – Canon – with small copiers. Furthermore, it failed to capitalize on unique inventions that were developed in its Silicon Valley laboratories, such as the mouse and inkjet printers, both used successfully by Apple later.

General Motors’ fixation on large, gas-guzzling cars of questionable quality caused it to fail to foresee the entry of Toyota and Honda into the U.S. market with small, high-quality cars that reduced GM to half the company it used to be.

We are not suggesting that you slaughter your cash cows on a whim. Singapore Airline’s cash cow is business class travellers and that is not going to change anytime soon. However, savvy competitors will attack your defences and sooner or later they will be breached. New technologies can never be put back into Pandora’s Box. So, if someone is going to destroy you cash cow, it might as well be you.

Sin 3: The Mature Market Syndrome. “Our industry is mature. There is no more growth in these markets.” Many people would claim that the reason products become generic, prices come down to the lowest levels, and growth stops is that the “market is mature.” Mature markets, in our view, are a myth.

Consider some examples. Who would have thought years ago that people would pay £150 for a pair of shoes? Running shoes at that! After all, everyone had a pair of £5 pumps, and the market was mature. Then along came Nike and Reebok, and the “mature market” exploded.

Who would have believed a few years ago that anyone would pay £3 for a cup of coffee? Yet Starbucks revolutionized the coffee business by introducing unique products and marketing in a “mature” industry dominated by Dunkin’ Donuts for decades. Dunkin’s Donuts had mastered the perfect 50-cent “bottomless” cup in the US. A cup of coffee, after all, was just a cup of coffee.

Two CEOs who have based their success on debunking the notion of “mature” markets are Jack Welch, General Electric’s famous ex-CEO, and Lawrence Bossidy, formerly CEO of Allied Signal. Jack Welch preaches that “mature markets are a state of mind,” while Bossidy says, “There is no such thing as a mature market. What we need are mature executives who can make markets grow.”

Sin 4: The Commodity Product Fallacy. “We’re in the commodity business” is another mind-set that can bring down a company’s supremacy. This is also a state of mind. Products become commodities when management convinces itself that they are. It’s a self-fulfilling prophecy. If you believe your product is a commodity, then so will your customers. If you believe your product is a commodity then investment in R&D will be cut back to zero and the focus instead shifts to production efficiency, leading to differentiation on price, the very definition of a commodity.

Kevin Surace is a serial entrepreneur, and former InfoTech executive, who established Serious Energy, a supplier of the new iWindow, based on a number of technical innovations to glass, a product that has been around for centuries. He put it this way, “Somehow buildings, which is a $5 trillion worldwide industry, was left to die. Everyone said it’s a commodity business. I said it is a commodity business because nobody went there to do anything about it. So they keep making the old [building material] products that they’ve made for a hundred years and they’ve commoditised themselves. I know companies that have not done a single bit of R&D for the last 30 years. It just became overhead. Now, they wouldn’t know how to develop a new product. The last person to do so died 30 years ago!”

Many food and drink manufacturers have leveraged “cash rich, time poor” and other consumer trends to turn old commodities into high value items. Take the humble lettuce, which after a simple clean cut and attractive packaging can see its sales value soar. With is its super- convenient Nespresso machine, which dispenses fresh espresso coffee at a touch of a button from individually sealed capsules, Nestle has successfully persuaded millions of consumers to pay around three times the price of regular ground coffee (on a pound for pound basis.)

Then there is the “mother” of all commodities – water. Yet, look at what the French did with water. They have mastered the marketing of this mundane commodity by branding it under a variety of names such as Vitel, Evian, and Perrier. Knowing that people are becoming more concerned about the quality of the water they drink, they began to market bottled water at exorbitant process. This concept was immediately successful even in places where tap water is excellent and essentially free. Through brilliant marketing, they made water “trendy,” creating “designer brands,” and they charged even more.

New-to-the-market products breed supremacy

Apple, 3M, Amazon, Microsoft, Johnson & Johnson, Caterpillar, and many others maintain their control of the sandbox not by introducing “me-too” products but rather by focusing their resources on the creation of new-to-the-market products. These have three inherent characteristics that contribute to breeding supremacy over their competitors:

A period of exclusivity. When you are the only product in the market, you are the only one.

Ability to charge premium prices. During this period of exclusivity, you can obtain premium prices, as opposed to me-too products, where every transaction comes down to haggling over price.

Ability to build in barriers. Being first to the market allows you to build in barriers that make it very difficult for competitors to gain entry into your game. Apple’s pursuit of Samsung through patents and other intellectual property is a good example.

After all, that’s what supremacy is all about: changing the game and creating the rules to which competitors who wish to play your game must submit.

The Strategic Product Innovation Process

Strategic supremacy is highly dependent on an organisation’s ability to create and bring to market new products more often and more quickly than its competitors. We view new product creation as the fuel of corporate longevity. The secret of these product innovator superstars is a deliberate process that causes product innovation. This systematic process is known and used by everyone in the company.

Observing this phenomenon, we at DPI went on to codify this process being practiced implicitly at these kinds of companies. The result is a unique process called “Strategic Product Innovation,” which makes new product creation a learnable, repeatable process. This process can be used by any organisation to create and commercialise new-to- market products, to generate new revenue streams, allowing the company to grow faster than its competitors. This conscious, repeatable, business practice consists of the following four steps:

Creation. Carefully monitor the 10 sources of change in your business environment from which you can create a broad range of opportunities for new-to-the-market products.

Assessment. Measure the new product opportunities in terms of costs, benefits, strategic fit, and difficulty of implementation. These criteria will let you know which opportunities should be pursued further – and which should be abandoned.

Development. Once a commitment is made, anticipate the critical factors that will cause the new product to succeed or fail.

Pursuit. Develop a specific implementation plan that promotes success and avoids failure.

The post How Strategic Product Innovation breeds Competitive Supremacy appeared first on Decision Processes International.

]]>The post Stealth Competition in the UK Grocery Sector appeared first on Decision Processes International.

]]>We believe that every robust strategy process must look beyond the conventional competitive environment and look at what may disrupt your business arena. DPI has named this competitive force the Stealth Competitor. The Stealth Competitor – or disrupter – has the ability to enter an industry and dramatically change the way the game gets played. The disruption caused by Aldi and Lidl to the UK grocery sector is a very recent example of how the Stealth Competitor has wreaked havoc on an industry.

For the “big 4” (Sainsbury’s, Asda, Tesco and Morrison’s), their Stealth Competitors didn’t even appear on their radar. Let’s take a closer look at how Aldi and Lidl have re-shaped the grocery sandbox and changed the rules of the game:

The rise of the LAD’s (limited assortment discounter):

Despite their strong market position, the big 4 have experienced significant declines in recent years. Tesco has dominated the media in recent months with the departure of Chief Executive Phillip Clarke in July. A further investigation into misreported profits has culminated in their Chairman announcing his departure this week. Shoppers meanwhile have started to turn to the LAD’s such as Aldi and Lidl.

Both Aldi and Lidl entered the UK market in the early 1990s and after 2 decades of moderate success, they seem to have finally built a killer proposition that resonates with UK shoppers. This has contributed to stellar growth since 2010. Lidl now has more than 600 stores in the UK and Aldi more than 500. Aldi expects to generate record sales of £7bn this year and Lidl UK expects to enjoy a similar turnover.

Impressively, whilst Aldi’s share of market is still modest, it has managed to reach No 1 in YouGov’s list of favourite brands, overtaking John Lewis and Samsung. It also expects to announce a 25% jump in annual sales when it issues its full-year figures shortly. In comparison, October 2014’s Kantar figures show Tesco’s sales are down 1.5% year on year; Sainsbury’s down 4% and Morrison’s down 4.6%.

How the two Stealth Competitors, Aldi and Lidl have turned the grocery sector upside down:

The big 4 have been playing to one set of rules; providing choice, a multi-channel shopping experience, and customer-focussed add-ons such as loyalty schemes. They have built a price strategy centered around defending themselves from each other. They have invested heavily in price-matching schemes, as a cornerstone of their strategy to compete on price with each other.

Behind the scenes, the discount retailers have been changing the rules in the Grocery Sandbox. They have been truly customer-centric in building their offer. They are reshaping the way we shop, and we like it!

There are several key tenets to their strategy:

1. Becoming “more British”

Their success has partly been the result of a wide-ranging customer review into customer perceptions commissioned in 2010, which showed for instance that shoppers wanted them to become “more British”.

They now source all their fresh meat, milk and eggs from Britain.

2. A more limited offering

The secret to their business model is having a limited range of goods. While Aldi sells 1,500 lines, a Tesco supermarket can sell 40,000. Ronny Gottsclich, the UK boss of Lidl puts it succinctly : “If you [and another customer] don’t know each other, would you like to pay for his choice of a different type of water? If you go to another retailer that has got 20 different types of water, someone has got to pay for that space, someone has got to pay for that rent.”

Whilst breadth of choice is a unique selling point for the big hypermarkets and superstores, not only is the customer paying for this, but to some extent they are bamboozled by it. Sales are declining in the large format stores; there is too much choice. For cash and time-strapped shoppers, the simplicity of Aldi and Lidl is appealing.

3. Capitalising on longer and more short-lived trends

They have also shrewdly cottoned on to trends, such as locally-sourced produce and producing dinner-party show-stoppers at bargain prices. The fashionable and decadent steak of the moment is Wagyu, and Aldi sell Waygu sirloin for just £6.69.

In our sport-obsessed summer, with the Tour de France in Britain, they launched a limited range of high-end bikes and a £65 GPS watch that measured your heartbeat, location, as well as the time.

4. An assurance of quality at the lowest price

Perhaps most importantly, they have seduced the shopper by offering random luxury goods, such as lobster tail and prosecco at incredibly affordable prices. This has created a viral buzz about the new Aldi and Lidl. In addition they carry international lines that have growing appeal. Whether it is extra virgin olive oil, parma ham or mascarpone, the prices are significantly lower than those in both Waitrose or Tesco. They have also recently introduced fine wines into London stores in a bid to attract more affluent shoppers.

DPI’s Stealth Competitor Process enables leaders to flush out these hidden threats. The LAD’s are becoming seemingly unstoppable. They have changed the game, they are dictating the new rules of engagement in the sandbox. The Big 4 and Waitrose were so busy watching each other they missed the Stealth Competitors. This is a good example of why the DPI Strategic Thinking process includes focus on understanding your sandbox and the entrant of Stealth Competitors.

Segment Description:

The UK grocery market was worth £174.5bn in the year to April 2014, and is growing at roughly 3% pa. Sales are split as follows:

42% hypermarkets and superstores 20% smaller supermarkets

21% convenience stores

6% discounters such as Aldi and Lidl 4.5% online

Remainder – other retailers

(Source – http://www.igd.com/our-expertise/Retail/retail-outlook/3371/UK-Grocery-Retailing/)

Grocery sales are dominated by the “big 4”: Tesco, Asda, Sainsbury’s and Morrison’s who had a combined market share of 73.6 per cent of the market in the 12 weeks ending 30 March 2014.

The post Stealth Competition in the UK Grocery Sector appeared first on Decision Processes International.

]]>